- 09/05/2025

- Posted by: Medical Billing Course

- Categories: Medical Billing, Medical Billing Course, Medical Billing Jobs

Medical billing is much more than just submitting claims and waiting for payments.

It’s a complex, specialized world where the rules and workflows change depending on the provider, the patient, and even the type of service delivered.

Whether you work in a solo clinic, a busy hospital, a dental office, or a behavioral health practice, understanding the different types of medical billing is essential for accuracy, compliance, and financial success.

In this comprehensive guide, you’ll discover exactly how hospital billing differs from physician and outpatient billing, why specialty fields like dental and mental health need their own approach, and what every biller and healthcare leader needs to know about working across multiple specialties.

If you’re building your career, managing a team, or running a practice, knowing these distinctions will help you avoid costly mistakes and keep your revenue cycle on track.

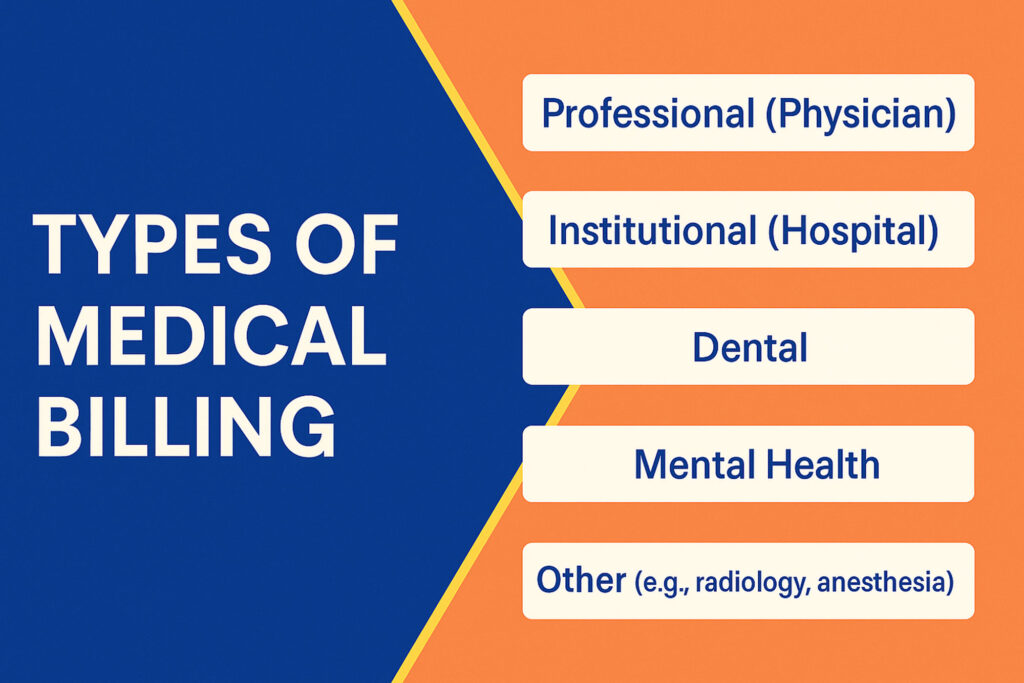

Types of Medical Billing

Let’s break down the main categories, the forms and code sets that define them, and the real challenges you’ll face in each.

a. Professional (Physician) Medical Billing

Professional medical billing, sometimes called physician billing, focuses on the work done by doctors, nurse practitioners, physician assistants, and other licensed healthcare providers in outpatient and office settings.

- Claim Forms & Codes: These claims are filed using the CMS-1500 form and require precise use of CPT (Current Procedural Terminology), HCPCS (Healthcare Common Procedure Coding System), and ICD-10 codes. These coding systems define every test, procedure, and diagnosis reported for payment.

- Workflow and Responsibilities: Billers in physician practices handle patient registration, insurance verification, charge entry, coding, claim submission, payment posting, and appeals. Accuracy is crucial; any coding mistake or missing modifier can trigger a denial.

- Typical Services: Routine check-ups, immunizations, minor surgeries, outpatient consultations, preventive care, and chronic disease management.

- Payer Complexity: Different payers (Medicare, Medicaid, private insurers) all have their own rules. The biller must keep up with ever-changing requirements and coverage policies.

- Challenges and Audit Risks: Common risks include upcoding (billing for a higher level of service than provided), unbundling (separating services that should be billed together), and missing documentation. The OIG regularly audits for these errors and issues guidance to help providers stay compliant.

- Career Impact: Mastering professional billing opens doors to jobs in clinics, urgent care, multispecialty groups, and physician billing companies. It’s also the foundation for learning more advanced or specialized billing.

If you’re new to the field, structured training such as the certification program from Medical Billing Course can help you master CPT coding, claims workflows, and up-to-date payer rules, giving you a real-world edge as a professional medical biller.

b. Institutional (Hospital) Medical Billing

Institutional medical billing, often called hospital medical billing, handles claims for services delivered by facilities, not just individual providers. This includes hospitals, outpatient surgical centers, rehabilitation clinics, skilled nursing facilities, and even some home health agencies.

- Claim Forms & Codes: Institutional claims use the UB-04 (CMS-1450) form. Unlike the CMS-1500, this form accommodates complex facility charges: room and board, medications, surgeries, anesthesia, lab work, radiology, and bundled care. Billers must master revenue codes, DRG (Diagnosis-Related Group) codes for inpatient stays, and CPT/HCPCS codes for procedures and ancillary services.

- Service Complexity: A single hospital stay may generate charges for multiple departments, dozens of providers, and bundled services (e.g., surgery with anesthesia and post-op care). Each component must be billed accurately and compliantly, following Medicare, Medicaid, or commercial payer contracts.

- Medical Billing for Different Practices: Facility-based practices, like oncology infusion centers or outpatient surgery suites, often blend institutional and professional billing, requiring dual knowledge from billers.

- Denial Triggers: Common pitfalls include mismatches between clinical documentation and billed services, missing or incorrect revenue codes, and late submission of claims.

- Compliance and Audit: Hospital billing is heavily audited, especially for compliance in coding, medical necessity, and “never events” (e.g., preventable hospital-acquired conditions). Inaccuracies can lead to multi-million dollar repayments and federal scrutiny.

Hospital billing is a career specialty of its own, often requiring additional certification and deep knowledge of both inpatient and outpatient workflows.

c. Dental Medical Billing

Dental medical billing is a unique specialty that bridges dental and traditional medical claims. It’s essential for providers who perform services that cross over between dental health and systemic health, such as oral surgeries, biopsies, or treatments for sleep apnea.

- Claim Forms & Codes: Dental claims typically use the ADA J430 form and CDT (Current Dental Terminology) codes. However, for certain medically necessary dental procedures (like jaw surgery after trauma or oral appliance therapy for sleep disorders), billing may require a CMS-1500 with medical CPT/HCPCS codes.

- Payer Rules: Navigating different payer requirements is a daily challenge. Some insurers require extensive documentation to justify why a dental procedure is medically necessary; others may split payment between dental and medical benefits.

- Common Procedures in Medical Billing Specialties: Wisdom tooth extraction under general anesthesia, treatment of oral infections that impact systemic health, oral cancer screenings, and trauma repairs are often covered by medical, not dental, insurance.

- Challenges: Billers must know which codes apply, how to document medical necessity, and how to coordinate benefits. Denials often result from incomplete documentation, mismatched diagnosis codes, or not following payer-specific billing rules.

- Specialization Opportunity: Dental medical billing is a fast-growing niche. Practices that can master both sides improve reimbursement and patient care, and billers who specialize here are in high demand.

Because rules and claim forms are so different from standard medical billing, many practices and new billers find that focused, specialty-specific training like the dental and mental health modules from Medical Billing Course streamlines onboarding and reduces costly errors.

d. Mental Health Medical Billing

Mental health medical billing is a highly specialized field shaped by unique coding rules, privacy protections, and payer requirements.

Unlike most other specialties, mental health billing often involves both medical necessity and time-based codes for sessions such as therapy, psychiatry, and substance use treatment.

- Coding and Claims: Mental health billers primarily use CMS-1500 forms with CPT codes (like 90834 for 45-minute psychotherapy) and ICD-10 diagnostic codes. Many payers require additional modifiers or prior authorization for certain services, especially intensive outpatient or partial hospitalization programs.

- Privacy and Compliance: Federal regulations, particularly HIPAA and 42 CFR Part 2, impose strict standards for sharing mental health and substance use disorder records. Billers must carefully manage who can access or release information, often needing patient consent for claim submissions. This level of compliance is vital for healthcare billing compliance and legal protection.

- Documentation and Denials: Insurers scrutinize mental health claims for medical necessity. Common denial reasons include missing treatment plans, lack of progress notes, or failing to justify session frequency. In mental health medical billing, thorough, up-to-date records are non-negotiable.

- Industry Trends: The rise of telehealth and digital mental health services has added new billing codes and requirements. Staying current with medical billing regulations is crucial for billers in this field.

Specialization in mental health medical billing offers opportunities in private practices, hospitals, behavioral health clinics, and telehealth startups, especially for those who can master compliance and complex payer rules.

e. Other Medical Billing Specialties

Medical billing is not limited to physicians, hospitals, dental, or mental health practices. Medical billing specialties extend into fields like radiology, anesthesia, pathology, chiropractic, durable medical equipment (DME), laboratory billing, and more, each with its own complexities.

- Radiology and Pathology Billing: These specialties deal with both professional and technical components (reading images vs. performing the test). Accurate use of modifiers and coding for global, technical, or professional charges is essential.

- Anesthesia Billing: Billing here is time-based, involving unique CPT codes, anesthesia modifiers, and the calculation of “base units” plus time units for procedures. Compliance in medical coding and billing is critical to avoid under- or overpayment.

- Chiropractic Billing: Chiropractors face restrictions on covered services, often requiring specific ICD-10 codes for spinal manipulation and frequent documentation updates to support continued care.

- DME and Laboratory Billing: Durable Medical Equipment claims must include precise HCPCS codes, modifiers, and proof of medical necessity, while lab billing often requires tracking orders, results, and payers’ unique reimbursement policies.

- Why Specialize? Specialization allows billers to develop expertise in complex regulations and payer quirks, improving claim accuracy and reducing denials. Many billing professionals start in a generalist role before narrowing their focus to medical billing for different practices or specific specialties.

- Industry Value: Billers with experience across medical billing specialties, especially in high-complexity fields, are sought after for their ability to manage multi-layered claims, regulatory changes, and specialty-specific audit requirements.

Advancing Your Career with the Right Type of Medical Billing Expertise

Choosing the right type of medical billing is more than a job decision; it’s a strategic move for your career and the success of your practice.

Each specialty, from professional and hospital billing to dental, mental health, and other medical billing specialties, comes with its own learning curve, coding systems, and compliance requirements.

The most successful billers are those who keep pace with changing regulations, invest in ongoing education, and develop real expertise in their chosen area.

If you’re just starting out or aiming to specialize, don’t rely on trial and error.

Structured, hands-on learning makes all the difference, especially as billing guidelines, payers, and software keep evolving.

That’s why programs like Medical Billing Course offer in-depth, up-to-date training for every major billing specialty, equipping you with the skills and confidence to succeed in any healthcare setting.

Mastering the nuances of different types of medical billing not only reduces denials and protects your revenue; it helps you build a resilient, rewarding career in the fast-changing world of healthcare finance.

Medical Billing Types & Categories: Frequently Asked Questions

What are the main categories or types of medical billing?

The main categories are professional (physician) billing, institutional (hospital) billing, dental billing, mental health billing, and various medical billing specialties like radiology or anesthesia. Each uses unique codes, claim forms, and workflows. Understanding these types is essential for accurate claims, compliance, and successful reimbursement across different healthcare settings.

How does medical billing vary by healthcare specialty?

Medical billing varies by specialty through differences in codes, documentation, payer rules, and claim forms. For example, dental uses CDT codes, hospitals use UB-04 forms, and mental health involves unique time-based CPT codes and privacy requirements. Each specialty has its own regulations and billing nuances, requiring specialized knowledge to maximize payment and avoid denials.

Is hospital medical billing different from private practice billing?

Yes, hospital billing (institutional) uses UB-04 forms, revenue and DRG codes, and covers facility-wide services. Private practice (professional) billing uses CMS-1500 forms with CPT and HCPCS codes for provider services. Hospital claims are generally more complex, often combining multiple services and providers in a single claim, and require deeper knowledge of compliance and payer contracts.

What are the challenges of billing for specific medical fields?

Challenges include mastering specialty-specific coding, meeting complex payer requirements, handling frequent regulation changes, and preventing denials due to documentation errors. For instance, dental and DME billing demand crossover coding, while mental health billing faces privacy and pre-authorization hurdles. Specialization is vital, as each field has unique rules, frequent audits, and evolving technology.

Can medical billers specialize in a particular type of billing?

Absolutely. Many billers develop expertise in fields like dental, mental health, hospital, radiology, or anesthesia billing. Specialization improves claim accuracy, speeds up the workflow, and reduces denials. It also boosts career prospects, as employers increasingly seek billers with in-depth knowledge of complex specialty requirements and changing payer rules.